![]()

Enjoy hassle-free payments when you automatically split your bills into 3, 6 or 12-month instalments.

![]()

Split your bills over up to 12 months (1% processing fee applies) for eligible GE Life and GE General Insurance premiums * .

For all other payments, split across 3 months for transactions between S$100 and S$1,000, or across 6 months for transactions of S$1,000 and above.

![]()

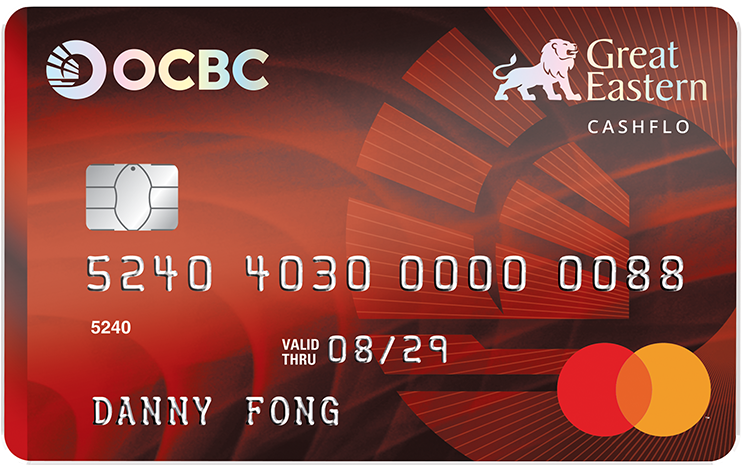

OCBC Great Eastern Cashflo Credit Card is an interest-free auto-instalment credit card that lets you split your payments without worrying about added interest costs.

![]()

For eligible transactions, earn 0.3% cash rebate if your monthly billed amount of eligible retail spend (excluding GE Life and GE General Insurance Premiums) is below S$1,000 and 1.2% if your monthly billed amount of eligible retail spend (excluding GE Life and GE General Insurance Premiums) is S$1,000 and above, capped at S$100 a month.

Note: From 1 October 2020, a processing fee of 1% will be imposed for Great Eastern premiums charged under a 12-month instalment plan to your card. In addition, cash rebates will no longer be awarded for Great Eastern premiums.

Great Eastern reserves the right to make changes to the eligible products. Please contact your Great Eastern Life Distribution Representative or Great Eastern Life at +65 6248 2211 for more information.

Getting startedEnjoy the benefits of your auto-instalment credit card with cash rebates of up to 1.2% and hassle free 3, 6 or 12 month payments.

Enjoy the benefits of your auto-instalment credit card with cash rebates of up to 1.2% and hassle free 3, 6 or 12 month payments.

For eligible transactions, earn 0.3% cash rebate if your monthly bill is below S$1,000 and 1.2% if your monthly bill is S$1,000 and above, capped at S$100 a month.

Note: From 1 October 2020, a processing fee of 1% will be imposed for Great Eastern premiums charged under a 12-month instalment plan to your card. In addition, cash rebates will no longer be awarded for Great Eastern premiums.

Before you applyS$30,000 and above for Singaporeans and Singapore PRs

S$45,000 and above for foreigners

S$163.50 (including GST), waived for the first two years

S$81.75 (including GST), waived for the first two years

Minimum spending required to have your Annual Service Fee automatically waived

S$5,000 in one year, starting from the month in which your OCBC Great Eastern Cashflo Credit Card was issued

Other fees and charges

Credit Bureau Singapore

Please note that additional time may be needed to review your application as Credit Bureau Singapore will be synchronising data from 12am to 8am daily.

MyInfo

MyInfo will be temporarily unavailable from 2am to 8.30am every Wednesday and Sunday due to scheduled maintenance.

System Maintenance

Please note that your product may not be availed to you instantly during system maintenance hours between 9.30pm to 6am.

This refers to the minimum amount for each transaction you made on the OCBC Great Eastern Cashflo Credit Card, before we automatically split the payment into instalments for you.

The default Trigger Amount which you can set when you apply for the card is S$100. This means all transactions of at least S$100 or more will be automatically split into instalments.

You can also set a higher Trigger Amount if you wish.

Can I change my Trigger Amount after I apply for the card?You can change the Trigger Amount from the default S$100 to another amount any time by contacting our hotline at 6363 3333 or +65 6363 3333 (from overseas).

Will all my OCBC Great Eastern Cashflo Credit Card transactions be automatically converted to instalments?

All eligible GE Life and GE General Insurance premium transactions will be converted to 12 month instalments, as long as the amount is at or above your preset Trigger Amount.

For other non-GE related transactions, selected transactions will not be converted automatically to instalments, e.g. cash advances, cash-on-instalment, balance transfers, transactions made at premises of or relating to casinos or online gambling entities etc.

Do all transactions qualify for rebates on the OCBC Great Eastern Cashflo Credit Card?Cash rebates are awarded only for retail purchases made on the card.

However, the following will not be taken into account in the award and computation of cash rebates:

You may refer to the Terms and conditions governing OCBC Great Eastern Cashflo Credit Card for the full list of excluded MCCs and merchant transactions.

Please note the following changes governing the use of your OCBC Credit Cards with effect from 1 July 2012.

The OCBC Travel Insurance Programme for OCBC Generic Visa Classic/MasterCard Standard, OCBC Generic Visa/MasterCard Gold, OCBC Titanium, OCBC Platinum, and OCBC Arts Platinum cards will be discontinued from 1 July 2012.

For a worry-free holiday, get the comprehensive travel protection you need with Explorer Travel Insurance.